SIC (Students Investment Contest) Judging Guidelines

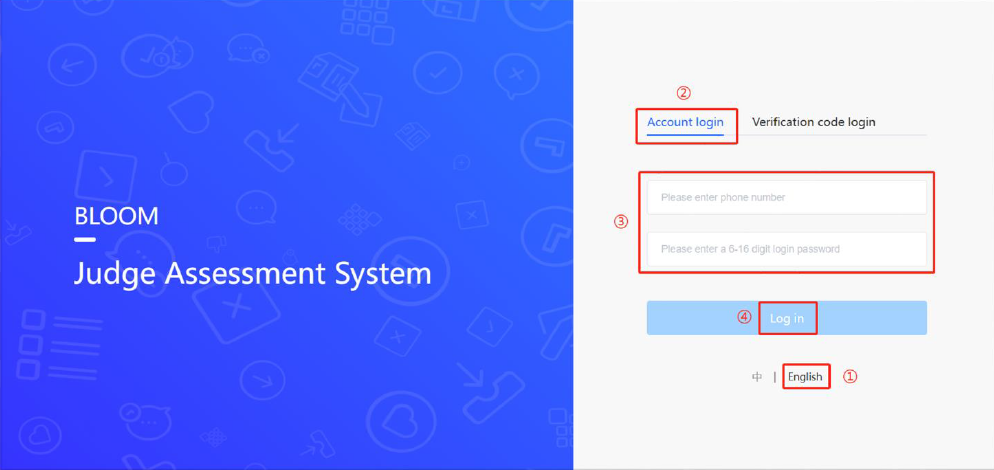

- Open the judge link of Bloom Judge System: https://jms.webloom.cn/#/login

- For languages, please choose English

- Select the [Account Login] to log in, and Fill in the [Phone Number] and [Password].

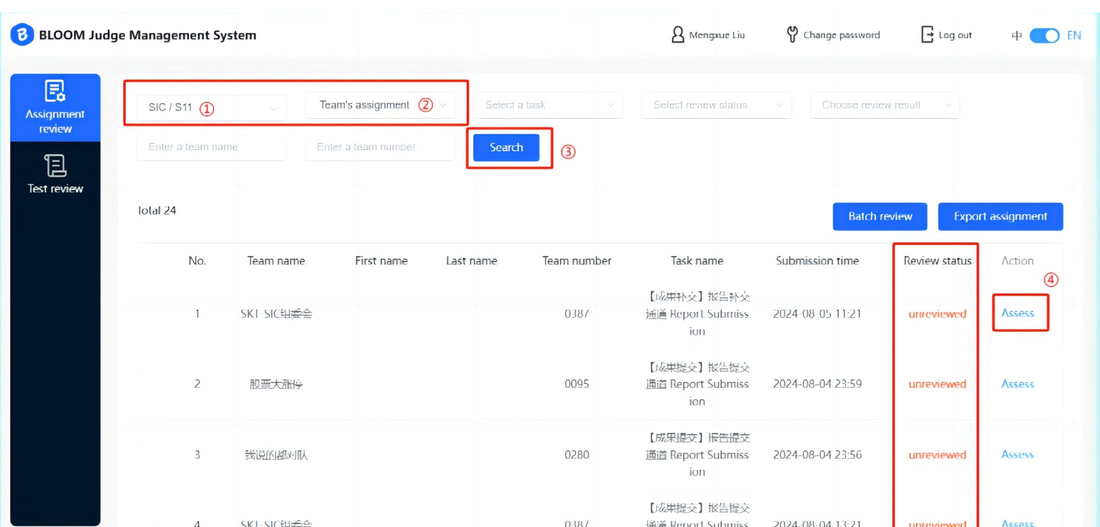

4. Select [SIC/S11]--[Team’s assignment]--[Search]—Select the unreviewed Report and Click [Assess]

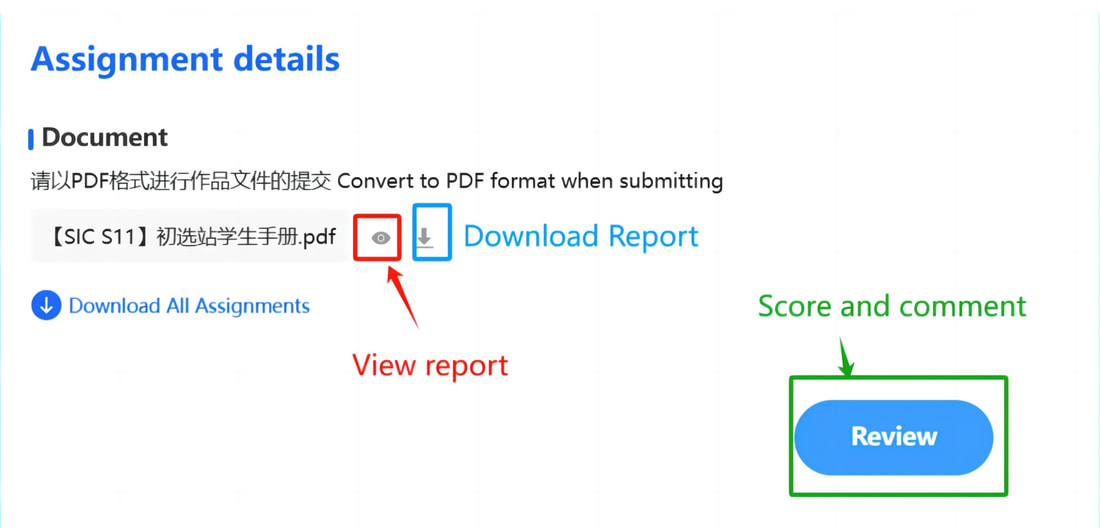

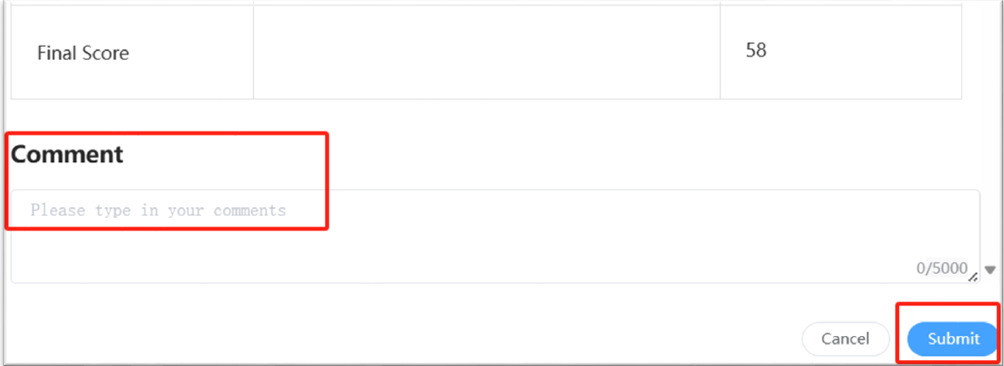

5. Click Preview to view the report, then click [Review], fill in the scores in the corresponding details (the system will automatically settle the total score). Then write comments.

6. When you finish filling in the grading and comments, you can click [Submit]. In addition, you can still modify the score after submission, and the new score will overwrite the previous score result.

Scoring Dimension

Dimension 1 - Strategy (0 - 20 points)

1) Clarity of Investment Strategy (0-5 points): How clearly is the investment strategy articulated? Is it easy for a reader to understand the overarching approach to investments?

2) Understanding of Portfolio Diversification (0-5 points): To what extent does the author showcase a grasp of portfolio diversification principles? Is there evidence of a well-diversified investment approach?

3) Construction of Balanced Portfolio (0-5 points): How effectively does the author construct a balanced portfolio that aligns with the stated investment strategy? Are there clear connections between the strategy and the portfolio construction?

4) Consistency with Investment Strategy (0-5 points): To what extent is the portfolio consistent with the outlined investment strategy? Does the composition of the portfolio reflect the principles laid out in the strategy?

Dimension 2 - Allocation & Selection (0 - 20 points)

1) Clarity of Allocation Strategy (0-5 points): How clearly is the portfolio allocation strategy explained, including sector and industry allocation? Are the rationale and methodology transparent?

2) Rationale for Securities Selection (0-5 points): Does the author provide clear and compelling rationales for selecting specific securities within the portfolio? Is there evidence of a thoughtful selection process?

3) Alignment with Overall Strategy (0-5 points): To what extent do the allocated sectors and selected securities align with the overarching investment strategy? Is there a cohesive relationship between allocation and strategy?

4) Flexibility in Allocation (0-5 points): Is there evidence of flexibility in the allocation strategy, allowing for adjustments based on market conditions or other relevant factors?

Dimension 3 - Risk Analysis (0 - 25 points)

1) Portfolio Performance Analysis (0-7 points): How comprehensive is the analysis of portfolio performance? Does the author consider relevant metrics such as returns, alpha, and beta?

2) Risk Analysis Metrics (0-8 points): To what extent does the risk analysis cover key metrics, including volatility, maximum drawdown, and other relevant risk indicators?

3) Integration of Risk Factors (0-5 points): Is there an integration of various risk factors into the analysis, considering both systemic and specific risks associated with the portfolio?

4) Actionable Insights from Analysis (0-5 points): Does the risk analysis provide actionable insights or recommendations for managing and mitigating risks within the portfolio?

Dimension 4 - Overall (0 - 25 points)

1) Effective Data Visualization (0-7 points): How well does the author use charts, tables, and graphs to illustrate opinions and findings? Are these visualizations effective in conveying information?

2) Independent Thinking (0-6 points): To what extent does the analysis showcase independent thinking? Is the author able to present unique perspectives or insights?

3) Logical and Detailed Analysis (0-7 points): How logically and in-depth is the analysis presented? Are there clear and detailed explanations supporting the opinions and conclusions?

4) Integration of Multiple Perspectives (0-5 points): Does the analysis consider and integrate multiple perspectives or counterarguments, showcasing a well-rounded approach?

Dimension 5 - Bonus (0 - 10 points)

1) Clear and Proper Structure (0-3 points): Is there evidence of a well-organized and structured report, with a clear flow of ideas and sections?

2) Accurate and Fluent Expression (0-3 points): How accurately and fluently is the information conveyed? Is the writing style clear, concise, and free of ambiguities?

3) Adherence to Report Format Rules (0-2 points): Does the report follow prescribed format rules? Is there compliance with any specific formatting guidelines provided?

4) Proper Citations (0-2 points): Are proper citations included where necessary? Does the author provide appropriate references for data, analyses, or external sources used in the report?

1) Clarity of Investment Strategy (0-5 points): How clearly is the investment strategy articulated? Is it easy for a reader to understand the overarching approach to investments?

2) Understanding of Portfolio Diversification (0-5 points): To what extent does the author showcase a grasp of portfolio diversification principles? Is there evidence of a well-diversified investment approach?

3) Construction of Balanced Portfolio (0-5 points): How effectively does the author construct a balanced portfolio that aligns with the stated investment strategy? Are there clear connections between the strategy and the portfolio construction?

4) Consistency with Investment Strategy (0-5 points): To what extent is the portfolio consistent with the outlined investment strategy? Does the composition of the portfolio reflect the principles laid out in the strategy?

Dimension 2 - Allocation & Selection (0 - 20 points)

1) Clarity of Allocation Strategy (0-5 points): How clearly is the portfolio allocation strategy explained, including sector and industry allocation? Are the rationale and methodology transparent?

2) Rationale for Securities Selection (0-5 points): Does the author provide clear and compelling rationales for selecting specific securities within the portfolio? Is there evidence of a thoughtful selection process?

3) Alignment with Overall Strategy (0-5 points): To what extent do the allocated sectors and selected securities align with the overarching investment strategy? Is there a cohesive relationship between allocation and strategy?

4) Flexibility in Allocation (0-5 points): Is there evidence of flexibility in the allocation strategy, allowing for adjustments based on market conditions or other relevant factors?

Dimension 3 - Risk Analysis (0 - 25 points)

1) Portfolio Performance Analysis (0-7 points): How comprehensive is the analysis of portfolio performance? Does the author consider relevant metrics such as returns, alpha, and beta?

2) Risk Analysis Metrics (0-8 points): To what extent does the risk analysis cover key metrics, including volatility, maximum drawdown, and other relevant risk indicators?

3) Integration of Risk Factors (0-5 points): Is there an integration of various risk factors into the analysis, considering both systemic and specific risks associated with the portfolio?

4) Actionable Insights from Analysis (0-5 points): Does the risk analysis provide actionable insights or recommendations for managing and mitigating risks within the portfolio?

Dimension 4 - Overall (0 - 25 points)

1) Effective Data Visualization (0-7 points): How well does the author use charts, tables, and graphs to illustrate opinions and findings? Are these visualizations effective in conveying information?

2) Independent Thinking (0-6 points): To what extent does the analysis showcase independent thinking? Is the author able to present unique perspectives or insights?

3) Logical and Detailed Analysis (0-7 points): How logically and in-depth is the analysis presented? Are there clear and detailed explanations supporting the opinions and conclusions?

4) Integration of Multiple Perspectives (0-5 points): Does the analysis consider and integrate multiple perspectives or counterarguments, showcasing a well-rounded approach?

Dimension 5 - Bonus (0 - 10 points)

1) Clear and Proper Structure (0-3 points): Is there evidence of a well-organized and structured report, with a clear flow of ideas and sections?

2) Accurate and Fluent Expression (0-3 points): How accurately and fluently is the information conveyed? Is the writing style clear, concise, and free of ambiguities?

3) Adherence to Report Format Rules (0-2 points): Does the report follow prescribed format rules? Is there compliance with any specific formatting guidelines provided?

4) Proper Citations (0-2 points): Are proper citations included where necessary? Does the author provide appropriate references for data, analyses, or external sources used in the report?

Questions? Please email to gicwins@gmail.com